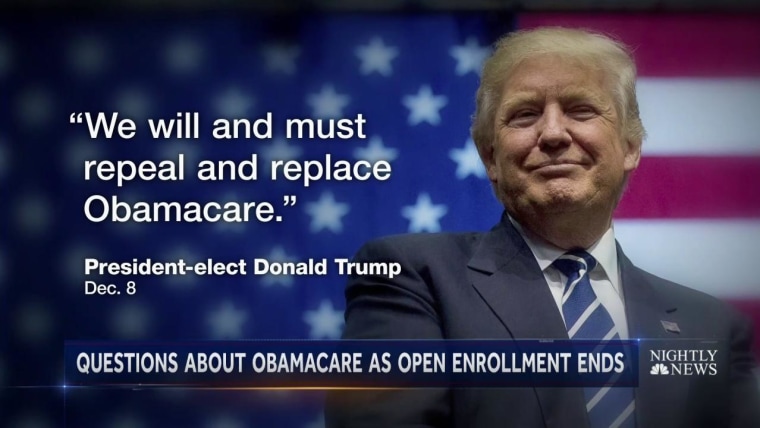

The Affordable Care Act, often known as Obamacare, has carried notable adjustments to the wellness insurance coverage field in the United States. One of the very most famous changes is the building of a Health Insurance Marketplace where individuals and small companies can go shopping for and buy health insurance policy strategy that fulfill their necessities and finances. Nevertheless, browsing the Health Insurance Marketplace can be baffling for those who are unknown with it or have certainly never had wellness insurance coverage before. In this blog message, we are going to deliver an introduction of the Health Insurance Marketplace and give tips on how to get through it properly.

What is the Health Insurance Marketplace?

This Is Noteworthy is an on the internet platform created by the government authorities to help individuals and tiny organizations compare and purchase health insurance coverage planning coming from different carriers. The marketplace offers a variety of health insurance coverage program that satisfy certain minimum specifications established by Obamacare, such as insurance coverage for vital wellness perks like precautionary treatment, prescribed medicines, maternity treatment, psychological health and wellness services, and even more.

One of the very most substantial advantages of buying for health and wellness insurance policy with the marketplace is that individuals may be qualified for economic support in paying for their premiums or out-of-pocket price. This aid is accessible to those who fulfill specific profit criteria based on their house size and site.

How to Browse the Health Insurance Marketplace

1. Recognize your application time frame

The enrollment time period for acquiring a health insurance policy strategy through the marketplace normally operates coming from November 1st to December 15th each year unless you train for a Special Enrollment Period due to specific life activities like getting married or losing your job-based coverage. It's necessary to understand when you may sign up in a plan so that you don't overlook out on insurance coverage.

2. Calculate your necessities

Before shopping for a program on the market place, it's essential to examine your healthcare need to have so that you can decide on a planning that satisfies them while keeping within your budget. Consider variables such as how often you see healthcare service providers, what prescription medicines you take, and whether you have any sort of persistent disorders that call for ongoing therapy.

3. Match up strategy

The industry delivers different types of wellness insurance policy strategy, featuring HMOs, PPOs, and EPOs. Each planning has actually its very own system of healthcare carriers and price linked with it. It's crucial to review planning carefully to guarantee that you choose the one that best fulfills your requirements.

4. Look for financial support

If you meet certain profit requirements based on your house dimension and location, you may be qualified for economic support in spending for your premiums or out-of-pocket price. You can easily calculate if you qualify through using the subsidy personal digital assistant on the industry website or communicating along with a industry agent.

5. Participate in a plan

Once you've determined your medical care requirements, reviewed planning, and determined if you train for financial help, it's time to register in a program on the market. You can easily do